Most people are familiar with valuations in the stock market. For example, you might compare a company's price-earnings (P/E) ratio to industry peers and determine if it's fairly valued. But, how do you accurately value a company that doesn't have revenue or earnings? And what if a company doesn't even have customers or a product yet?

Let's look at how to value early-stage startups using what's known as a pre-money valuation.

What is a Pre-Money Valuation?

Early-stage investors generally want to support innovation, but they also want to make an attractive return on their investment. As a result, most angel investors, venture capitalists, and private equity firms want equity. Then, when the company goes public or gets acquired, investors can make a significant return on their original investment.

Startups that raise capital usually start with a seed round before continuing to a Series A, B, and C round. However, investors need to know the value of the business before committing any capital. The valuation considers the business's financial statements, management team, market size, and other factors to assess the opportunity.

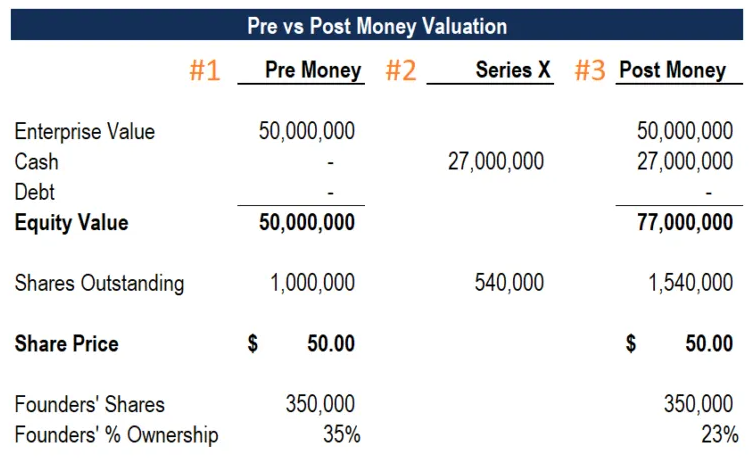

A startup's pre-money valuation is its value before any outside investment or financing. In addition to valuing the business, pre-money valuations determine what share of the company investors get for their investment. For example, if you invest $250,000 in a startup with a $1 million pre-money valuation, you would own 25% of the business.

Pre-money vs. post-money valuation. Source: Corporate Finance Institute

After the investment finishes, the startup's post-money valuation reflects the newly-received capital. In the example above, the pre-money valuation is $50 million with one million shares outstanding. The post-money valuation increases the equity's value by the amount raised and increments the share count, lowering the founder's ownership stake.

How to Set a Pre-Money Valuation

Most early-stage companies have little to no track record, making it difficult to assign a valuation. And in some cases, the business may not even have customers, products, or users. That's why most pre-money valuations don't come from accounting measures like revenue or EBITDA. Instead, they're highly-negotiated numbers driven by market forces.

Investors may factor in several things:

Comparables: Many public companies are valued based on their peers. For example, you might look at other companies in the same industry to determine a valuation.

Founders: Many investors place a lot of faith in the founding team. If the team has a strong track record or deep expertise, they could be more likely to succeed.

Interest: Startups with a lot of buzz surrounding them are better positioned to push for a higher valuation. On the other hand, deals with low demand could see lower valuations.

Many investors put these factors and others into a “valuation scorecard,” where they rate them from -3 (worst) to +3 (best). Then, they assign each factor a weight (0-100%) and multiply the value by the weight. Finally, they multiply the sum by the average pre-money valuation for the business’ industry to come up with an estimated valuation.

The Dave Berkus valuation methodology takes a different spin on this approach by simply adding £0.4 million increments for various characteristics, including quality management team, sound idea, working prototype, quality board of directors, and product rollout or sales. Of course, this method only works for very early stage investments given the low maximum value.

Finally, other investors try to determine a startup’s future selling price by looking at revenue expectations and industry multiples. Next, they divide that amount by their anticipated return on investment to come up with a valuation. The drawback of this “venture capital valuation methodology” is that it’s much less precise than the other two methods.

Pre-Money Valuation & Deal Terms

The difficulty in coming up with early-stage valuations can lead to unique deal terms. While public companies issue straight equity, many startups issue preferred stock or convertible debt when there is disagreement or uncertainty around the valuation. The favorable liquidation preference, participation rights, and dilution protections offset risk for investors.

Some of the most common deals include:

Preferred Stock: Preferred stock is equity with liquidity preference and other benefits over common stock. For example, preferred stock owners may get paid first in the event of a bankruptcy or have double the votes of a common stock.

Convertible Notes: Convertible notes are short-term debt securities that are automatically converted into equity when milestones are reached. Since it’s debt, it’s much easier than equity from a legal and accounting standpoint.

SAFEs: Simple agreements for future equity, or SAFEs, are a non-debt replacement for convertible notes. The approach—popularized by YCombinator—has become one of the most common ways for modern startups to raise capital.

Of course, these agreements have consequences for founders. In particular, founders with multiple SAFE notes at various valuation caps may not be able to raise Series A funding if there’s a waterfall of dilution on the horizon. Moreover, founders that don’t understand the cap table math behind these notes may be surprised by the level of founder dilution.

The best way for founders to avoid these problems and investors to remain on good terms is to come up with a pro-forma cap table before issuing any notes. That way, everyone is on the same page regarding the potential dilution before the notes are accepted, and there won’t be any nasty surprises in the future when the notes convert to equity.

The Bottom Line

Pre-money valuations are simply a startup's valuation before raising capital. While the concept is simple, coming up with a valuation before a business has products or customers is a significant challenge. Many investors solve these challenges by using preferred stock, convertible notes, or SAFE agreements.

If you're an early-stage startup, Intent can help you plan a minimum viable product (MVP) and bring it to market. We provide a wide range of services, including design, development, maintenance, due diligence, and consulting, with a focus on connected devices. And we’ve worked with startups funded by Andreessen Horowitz, Box Group, and other funds.

Contact us for a free consultation and learn how we can accelerate your business.

Greg Cargopoulos

Marketing Lead