MedTech has become one of the most exciting subsets of the tech industry with the success of mRNA manufacturing in combating the COVID-19 pandemic and the growing ubiquity of wearable devices. With billions of dollars flowing into the sector, the pace of innovation could accelerate even further in 2022 and beyond.

Let's look at seven MedTech trends that MedTech companies and investors should watch over the coming years.

#1. Growing Investment

Venture capital, private equity, and strategic investors continue to fund medical devices, digital health, robotics, and other MedTech innovations.

MedTech companies raised over $11 billion in 2021, according to Fierce Biotech, exceeding the previous record of $7 billion in 2017. But interestingly, the record investment was concentrated in just over 170 deals – the lowest number in a decade's worth of analysis. These figures suggest that more money is going into fewer startups.

For example, Caris Life Sciences, an AI-powered business developing early-stage cancer detection in blood samples, raised $830 million in May 2021. In fact, the majority of last year's top fundraisers are working on in-vitro diagnostics, genomic sequencing, or AI-based technologies, drawing capital from biotech and tech investors.

#2. Most Exits Are M&A

The most common MedTech exits will remain mergers and acquisitions, although there have been some high-profile initial public offerings.

The MedTech space had about $31.5 billion in M&A during the first half of 2021, according to Fierce Biotech, and the pace has only accelerated into 2022. For instance, Danaher spent $9.6 billion last year to purchase the DNA and mRNA manufacturer Aldevron just a year after spending $21.4 billion to acquire General Electric's life sciences business.

While M&A will continue to be essential for large companies to combat patent attrition, rising interest rates could make financed deals (e.g., leveraged buyouts) less common. According to the CME's FedWatch tool, interest rates could hit a 3.50% to 3.75% range by the February 2023 meeting – a significant increase over the past year.

#3. Data Breaches on the Rise

The MedTech industry has seen a rise in the collection, analysis, and distribution of healthcare data that could introduce new security risks.

The FDA's recently launched Digital Health Center for Excellence aims to monitor industry innovations in these areas. For example, the Digital Health Software Pre-certification Program will expand the agency's mandate beyond physical products to the software behind the product, ensuring the stability of cutting-edge physical devices.

At the same time, wearables and other devices collect and store data on cloud computing services, like Amazon AWS or Microsoft Azure. While data breaches affect every business, health care data is protected by HIPAA and other laws, making it especially sensitive. As a result, companies will have to double down on cybersecurity investments.

#4. Wearables Become Ubiquitous

Wearable devices are becoming increasingly ubiquitous throughout the United States and worldwide.

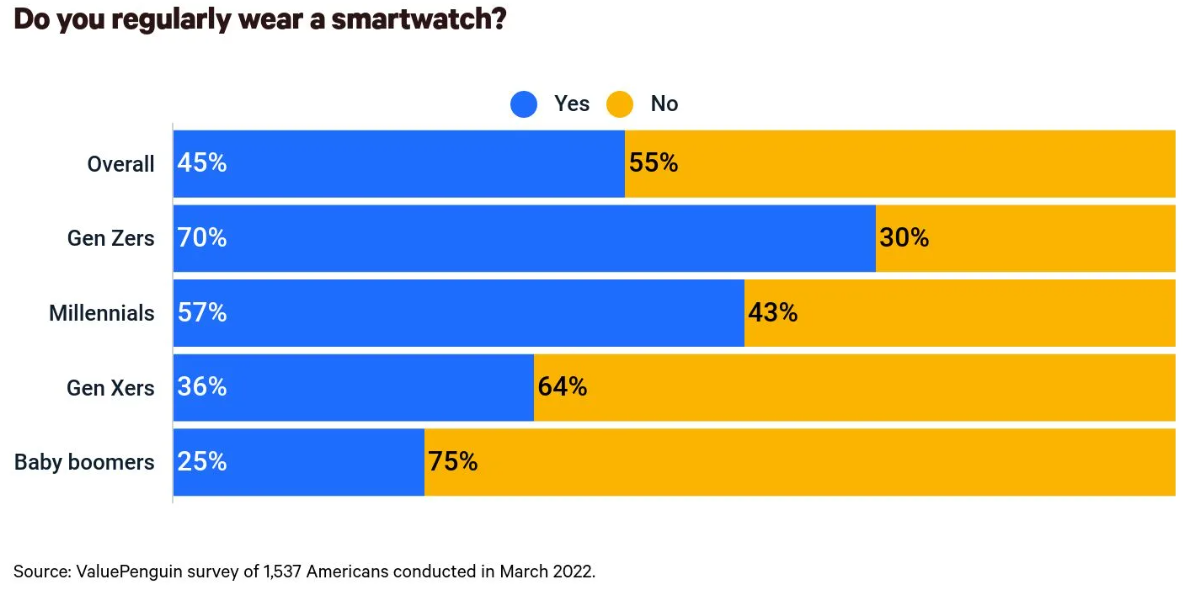

About 45% of Americans already wear smartwatches, according to Value Penguin, while 69% would be willing to wear one if it meant a health insurance discount. Researchers also found that users value the biometric data collected by these wearables, with more than 40% of users talking to their doctor about their biometric data.

Younger generations adopt wearables at a faster pace than other markets. Source: Value Penguin

Report Ocean estimates that the global smart wearable devices market will reach $137.15 billion by 2030, growing at a 14.7% compound annual growth rate between 2020 and 2030. As a result, Apple, Fitbit, Garmin, and other incumbents could see greater competition from startups developing innovative new sensors or approaches.

#5. IP Plays a Critical Role

Intellectual property, or IP, is essential to protect MedTech innovations and maintain a competitive edge.

MedTech is one of the most patented technical fields for newly registered innovations, according to MedTech Pulse, ahead of digital communications and computer science. For instance, Medtronic filed nearly 27,000 patents between 2011 and 2020, followed by Johnson & Johnson with over 26,000 patents in the MedTech space.

These patents typically fall into two categories: Design patents that help protect the "look and feel" of wearables and other devices, and utility patents that can help protect the underlying functionality.

Understanding the landscape of regulations and patents will prove crucial to any device looking to penetrate into the MedTech environment - making the importance of teaming up with a partner experienced in navigating existing patents even greater.

#6. Telemedicine Drives Growth

The COVID-19 pandemic led to a telehealth explosion, providing solid tailwinds for the MedTech space.

Just 11% of U.S. consumers were using telehealth in 2019, according to McKinsey, but that figure jumped to 46% in 2021. In addition, more than three-quarters of Americans are interested in using telehealth in the future to complement in-person doctor visits. As a result, VCs poured more than $3 billion into the industry in just nine months in 2020.

The interest in telemedicine on the part of doctors could pave the way for wearables and other small medical devices. For instance, doctors might use Apple Watch data to measure a person's physical activity after surgery, or continuous glucose monitoring to evaluate a diabetic patient's adherence to a dietary plan.

#7. AI Drives Value

The growth in wearables has led to an explosion in data, and artificial intelligence will be central to unlocking the value of that data.

Artificial intelligence and machine learning algorithms can take raw data and derive insights using artificial neural networks and deep learning techniques. For example, AI is already prevalent in radiology, oncology, dermatology and other medical disciplines, where it can quickly analyze data and identify patterns invisible to the human eye.

At the same time, software developers need to know how to build applications that visualize data in the most effective way and encourages users to take action. Intent helps hardware-focused MedTech businesses develop robust user experiences that enhance the value of their products.

We have helped Oura to develop their smart ring and mobile apps and BOSE to develop their SoundControl™ hearing aids, built to FDA II regulations and requirements.

The Bottom Line

The MedTech industry continues to innovate with the rise of wearable devices and artificial intelligence enabling unparalleled insights into health and wellness. Startups and investors in the space should keep an eye on these developments, along with the risk of data breaches and other trends to successfully navigate the market over the coming years.

If you're a startup in the space, Intent can help you create the best possible user experience for your hardware and navigate the complicated world of patents and regulations.

Contact us today to discuss your project!

Greg Cargopoulos

Marketing Lead